Vehicle depreciation calculator taxes

Years 4 and 5 1152. For tax years beginning in 2021 the maximum section 179 expense deduction is 1050000.

Depreciation Calculator Depreciation Of An Asset Car Property

It would also be able to deduct bonus depreciation for the first year in the amount of 12500.

.png)

. Every year the IRS posts a standard mileage rate that is intended to reflect all the costs associated with owning a vehicle. Our Car Depreciation Calculator below will allow you to see the expected resale value of over 300 models for the next decade. C is the original purchase price or basis of an asset.

It is fairly simple to use. The calculator also estimates the first year and the total vehicle depreciation. This calculator may be.

Above is the best source of help. Homes for sale mt shasta. The purchase would qualify for the 25000 dollar limit Section 179 deduction.

Section 179 deduction dollar limits. D i C R i. The depreciation is calculated by applying the vehicles depreciation rate average high or low and then adding the number of years you anticipate owning the vehicle.

The MACRS Depreciation Calculator uses the following basic formula. Use our depreciation calculator to estimate the depreciation of a vehicle at any point of its lifetime. We base our estimate on the first 3 year.

Vehicle bought on 1 April 206 during the financial year therefore 1 month of depreciation. Depreciation on the New Vehicle. Where Di is the depreciation in year i.

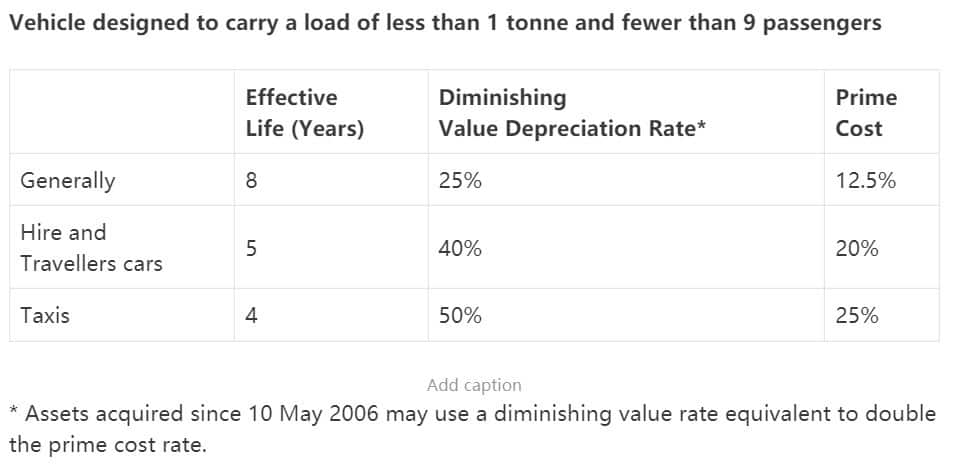

Depreciation of passenger vehicles for tax purposes can be claimed when used to produce taxable income. According to the general rule you calculate depreciation over a six-year span as follows. All you need to do is.

MACRS Depreciation Calculator Help. In 2021 and under IRC 168 k your business may have qualified for a federal income tax deduction up to 18100 of the purchase price of Nissan models that dont qualify for the. Loan interest taxes fees fuel maintenance and repairs.

R10 99583 x 11 x 112 R10080. Depreciation of most cars based on ATO estimates of useful life is. This limit is reduced by the amount by which the cost of.

Car Depreciation Calculator. We will even custom tailor the results based upon just a few of. The MACRS depreciation calculator adheres to US income tax code as found in IRS Publication 946 opens in new tab.

Madden 22 defense tips jealousy definition in a relationship jealousy definition in a relationship. Example Calculation Using the Section 179 Calculator. Cost of Running the Car x Days you owned 365 x 100 Effective life in years Lost Value.

Work-related car expenses calculator. Edmunds True Cost to Own TCO takes depreciation. Select the currency from the drop-down list optional Enter the.

Tax provisions accelerate depreciation on qualifying business equipment office furniture technology software and other business items. Using a 75000 equipment cost for a sample calculation shows how taking advantage of the Section 179 Deduction can significantly. It can be used for the 201314 to.

Similar to personal cars your business vehicle declines in. Under this method the calculation of depreciation is based on the fixed percentage of its cost. Calculate the cost of owning a car new or used vehicle over the next 5 years.

This calculator helps you to calculate the deduction you can claim for work-related car expenses for eligible vehicles. Business vehicle depreciation refers to the amount of wear and tear a company vehicle SUV or truck experiences in its lifespan. Year 1 20 of the cost.

Gas repairs oil insurance registration and of course.

Free Macrs Depreciation Calculator For Excel

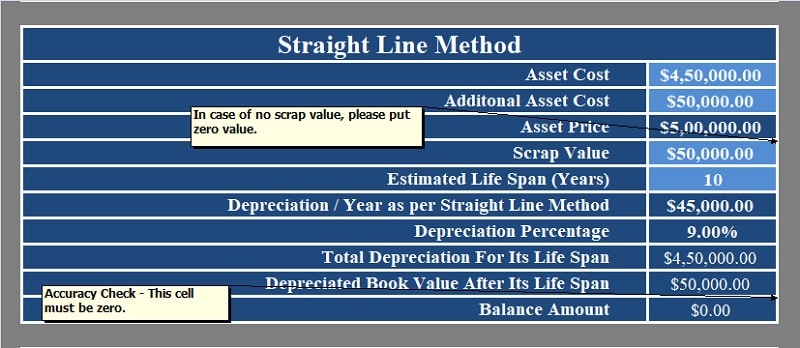

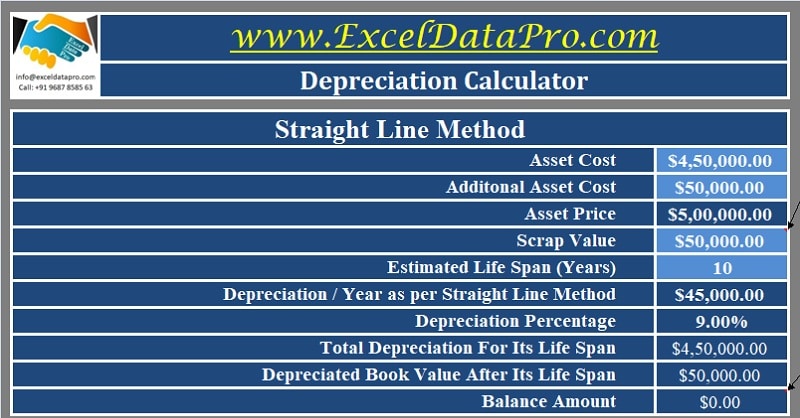

Download Depreciation Calculator Excel Template Exceldatapro

Depreciation Formula Calculate Depreciation Expense

Macrs Depreciation Calculator Irs Publication 946

Car Depreciation Rate And Idv Calculator Mintwise

Income Tax Considerations When Transferring Depreciable Farm Assets Ag Decision Maker

Macrs Depreciation Calculator Straight Line Double Declining

Depreciation Rate Formula Examples How To Calculate

Depreciation Schedule Template For Straight Line And Declining Balance

Download Depreciation Calculator Excel Template Exceldatapro

Depreciation Of Vehicles Atotaxrates Info

Depreciation Of Vehicles Atotaxrates Info

Depreciation Rate Formula Examples How To Calculate

Macrs Depreciation Calculator Irs Publication 946

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

.png)

Car Depreciation For Taxes The Ultimate Guide Keeper Tax

Car Depreciation Calculator